Produced for:

Publish date: November 2021

Sterling Perrin

Sr. Principal Analyst – Optical Networking & Transport

The advent of coherent detection revolutionized the dense wavelength division multiplexing (DWDM) market and led to a set of sustaining innovations over the past decade that delivered ever-increasing capacity and lower costs per bit. Now, the optical industry is hitting an inflection point as coherent innovation forks in two different but equally important directions.

On one end, high performance optics drives capacity toward 1Tbps per wavelength as the laws of physics approach the maximum channel capacity as defined by the Shannon Limit. Components and systems vendors are developing new innovations that eke out more capacity on fiber, but each innovation comes with increased cost and complexity. The state-of-the-art in highest performance commercial embedded optical systems is 800Gbps, powered by 7nm, and 90+ Gbaud digital signal processing (DSP).

On the other end, compact pluggable optics are converging at 400Gbps transmission, the data rate that is set to play a dominant role in optical networks over the next decade. New pluggable coherent form factors hold potential for lowering capex, fostering optical layer interoperability, and defining new metro/regional network architectures (e.g., IP over DWDM [IPoDWDM]).

The divergence of coherent pluggable and embedded optics trajectories and the convergence of IP and optical in IPoDWDM architectures create new opportunities, along with many questions. Heavy Reading decided the timing was right to launch an in-depth global operator survey on the future of coherent optics at 400G, 800G, and beyond. Project partners were Cisco Systems, Infinera, and Juniper Networks.

This white paper is based on the survey results and provides the industry’s most in-depth look at the current state and future trajectory of coherent optical transmission along both innovation tracks:

Within the context of 400G pluggable optics, the study also examines communications service providers’ (CSPs’) views on and plans for IPoDWDM.

In this special webinar, Heavy Reading will be joined by leading experts from Cisco, Infinera and Juniper to unveil key findings from Heavy Reading’s 2021 global coherent optics operator survey and plot a roadmap for both high-performance embedded optics at 800 Gbit/s and 400G pluggable optics.

This survey section focuses on the emerging trends in 400G coherent pluggable optics, including 400ZR and 400G ZR+. Service providers and vendors define terms a bit differently. For this survey, Heavy Reading supplied the following definitions for respondents:

Further, “coherent pluggable optics” is a general term that encompasses any pluggable form factor type of any coherent data rate, including standardized and proprietary form factors and optics.

The 400ZR specification was defined by the OIF with the goal of integrating 400G pluggable coherent DWDM modules within next-generation 400 gigabit Ethernet (GbE) routing and switching platforms. The hyperscalers see 400G coherent pluggables for massive point-to-point connectivity between data centers as their primary use case, but one of the main themes to emerge from this Heavy Reading study is that coherent pluggable optics apply well beyond DCI.

Heavy Reading asked CSPs to identify all the physical topologies they are considering for 400G pluggables. Respondents were allowed to select all options that apply and were asked to answer separately for 400ZR and for 400G ZR+. Results are shown in Figure 2.

Unsurprisingly, unamplified point-to-point links are the top expected topology for 400ZR. Selected by 63% of respondents, the option is consistent with the dominant <80km DCI use case that drove 400ZR standardization. For 400G ZR+, amplified single-span topologies are the top choice, as CSPs seek the higher performance of ZR+ to address longer DCI links in their networks.

More surprising is a strong interest in more complex topologies. A majority of respondents (at 56%) anticipate 400G ZR+ in multi-span point-to-point networks and in ring/mesh topologies. At 53%, a majority of CSPs anticipate 400ZR pluggables in ring/mesh topologies and nearly half (46%) anticipate 400ZR pluggables in amplified multi-span networks.

Heavy Reading does expect 400ZR optics to dominate amplified single-span deployments, providing the lowest cost option in this use case. 400G ZR+ optics, with up to 0 dBm transmit output power, will likely provide a further performance boost for multi-span and ring/mesh topologies. Testing and validation will determine where 400ZR and 400G ZR+ are ultimately deployed, but CSPs clearly envision coherent pluggables addressing a broad spectrum of use cases in their metro and regional networks—well beyond point-to-point DCI.

Figure 2: What physical topology are you considering for 400G pluggable optics?

n=81

Source: Heavy Reading, 2021

Nx100G multiplexing and reconfigurable optical add-drop multiplexer (ROADM) and filter compatibility top the list of important features for coherent pluggable optics, selected as “critical” features by 33% and 29% of respondents, respectively. (See Figure 3). Both results point to the importance of technology flexibility and its ability to operate in brownfield networks. 400G will be the data rate currency for upgrades, but 100G links will remain in networks for a long time—thus, requiring 100G multiplexing. Similarly, ROADMs are widely adopted in metro and regional networks and must be accommodated.

Also important for coherent pluggable optics is Precision Timing Protocol (PTP) support to meet network synchronization requirements for 5G transport, selected as critical by 25% of survey takers. Layer 1 encryption for data centers is also rated as highly relevant, although Heavy Reading expects that this will more often be addressed through MACsec encryption when 400ZR and 400G ZR+ optics are used inside switches and routers.

Figure 3: Which of the following features are important for your coherent pluggable optics networks?

n=81

Source: Heavy Reading, 2021

As already noted, CSPs envision that coherent pluggables will be used to address use cases well beyond point-to-point DCI. Additional survey results further underscore this conclusion. Heavy Reading asked respondents to estimate the percentage of 400G links that will be driven by 400ZR/400G ZR+ in different parts of the network. Results point to strong adoption across DCI, aggregation, metro core, and even long-haul core segments (see Figure 4).

By 2025, the majority of respondents expect greater than 25% penetration of 400ZR/400G ZR+ in each of the major transport segments and with a fairly even distribution across them—ranging from 63% for the DCI segment to 70% for long haul. Heavy Reading did not ask respondents to break out 400ZR and 400G ZR+ separately, but based on the distance limitations of 400ZR, we can assume that metro core and long-haul core reflect expectations for 400G ZR+. More than one-third of respondents expect greater than 50% penetration for 400ZR/400G ZR+ in metro aggregation (33%), metro core (35%), and long-haul core (35%) segments by 2025.

Figure 4: Between now and 2025, roughly, what percentage of 400G links will be driven by 400ZR and/or 400G ZR+ in the following parts of the network?

n=81

Source: Heavy Reading, 2021

Openness is a key area of interest in optical networking generally and in pluggable optics specifically. “Openness” has many degrees, and a crucial question for the future of coherent pluggables is: what level of openness will be required? Heavy Reading asked respondents to prioritize the importance of two levels of openness:

Some components suppliers will not be pleased to hear that CSPs are most interested in full interoperability that gives service providers the most flexibility but makes the most work for the suppliers to achieve full spec compliance. For 38% of respondents, full interoperability is a high priority, while bookended openness is a high priority for just 20%—a significant difference in prioritization. Full interoperability is rated a low priority for just 12% of the survey group (see Figure 5).

Figure 5: How much of a priority is each of the following open networking approaches within your organization?

n=74

Source: Heavy Reading

Lack of compatibility with existing routers and unproven/immature technology top the list of barriers to 400G ZR+ adoption, according to the survey. Lack of compatibility with routers was chosen by 44% of respondents, while unproven/immature technology and ecosystem was selected by 39%. These two issues form a top tier of CSP concerns, and the data is consistent with similar findings in other recent Heavy Reading research on open networking and pluggable optics (see Figure 6).

Several other barriers form an important second tier of adoption barriers, specifically increased operational complexity (selected by 34% of respondents), lack of integrated end-to-end management, and lack of compatibility with the existing DWDM network (each selected by 31% of respondents). Interestingly, CSPs view compatibility with the routers as a bigger concern than compatibility with the DWDM network itself. Perhaps this is because the open line system concept has matured over the past five years.

In any case, results underscore the inter-dependence between 400G ZR+ and IPoDWDM. (Heavy Reading explores 400G and IPoDWDM in detail in the next section).

Figure 6: What are the most significant barriers to deploying 400G ZR+ in your network? (Global)

Views on deployment barriers vary significantly depending on geographic region. US respondents view the lack of compatibility with existing routers as the biggest barrier (selected by 48%) but are relatively comfortable with the maturity of 400G ZR+ technology. At 27%, unproven/immature technology falls in the middle in terms of concerns. However, for the rest of the world (RoW) CSPs surveyed, unproven/immature technology is the primary barrier to adoption, as selected by 53% of respondents (see Figure 7).

Figure 7: What are the most significant barriers to deploying 400G ZR+ in your network? (US vs. RoW)

While the first 400ZR modules are shipping commercially in 2H21, work has already started on the next coherent pluggable data rate at 800G. The OIF 800G Coherent project began in December 2020, roughly five years after the 400ZR project was launched.

Heavy Reading wanted to understand the degree to which 800G development is influencing CSPs’ current 400G pluggable plans. According to the survey, a vendor’s roadmap to coherent 800 is important for many, but it is not a critical consideration—at least not yet. While 46% of respondents rated a coherent 800G roadmap as “important,” just 15% rated the 800G roadmap as “critical” (see Figure 8). The lukewarm assessment of coherent 800G is not surprising given the early stage of 800G development and the fact that commercial 400G coherent pluggables are just now hitting the market. Coherent 800G commercialization is still several years away.

Figure 8: How important is a vendor roadmap to coherent 800G in your consideration to deploy coherent 400G today?

n=81

Source: Heavy Reading. 2021

Lastly, the coherent optics survey touched on the newest addition to coherent pluggable optical modules, XR optics technology. Pioneered by Infinera, XR optics is a sub-carrier-based coherent technology for point-to-point and point-to-multipoint topologies, with data rates ranging from 25Gbps up to 400Gbps. Most recently, the Open XR Forum was formed in 2021 to promote open, standards-based adoption of XR optics.

The technology is very new (there are no commercial products yet), but Heavy Reading asked one survey question about the potential benefits of an XR optics architecture (see Figure 9).

Many potential XR optics benefits resonate with CSPs, with simplicity of optical generational upgrades, reduced number of transceivers by 50%, and simplified router hardware topping the list, selected by 46%, 43%, and 41% of respondents, respectively. The early potential is consistent with anecdotal feedback from Tier 1 CSPs, and Heavy Reading notes that BT, Lumen, Windstream, Virgin Media, Colt, and Verizon are all Open XR Forum members. The biggest surprise is the high level of general awareness at this early stage. Just 7% of respondents reported that they are unaware of this technology.

Figure 9: What are the most significant benefits you see from advanced network architectures that include point-to-multipoint XR optics technology?

n=81

Source: Heavy Reading. 2021

The physical integration of long-reach pluggable optics on routers—known as IPoDWDM—has been around for many years, but with limited market adoption. At 400G, however, IPoDWDM has knocked down the significant historical barriers and is poised to move into the mainstream, as Figure 10 illustrates.

Figure 10: Pluggable 400G DWDM is a gamechanger

Coherent pluggable optics adhering to 400ZR and 400G ZR+ specifications are the primary catalyst for the new era of IPoDWDM, though other innovations also play a major role. Other contributing innovations include the adoption of open line systems and the maturation of open control and management plane software and APIs (i.e., SDN).

This survey section examines operator views on and plans for integrated 400G coherent optics on switches and routers.

Heavy Reading asked respondents to identify the systems on which they plan to use 400G pluggable optics, including traditional DWDM systems, disaggregated (or purpose-built) transponder shelves, and switches and routers. Respondents were able to pick all relevant systems for coherent 400G pluggables, so results in Figure 11 total greater than 100%.

At 54% and 53%, respectively, fully integrated DWDM systems and switch/routers are statistically tied as the primary platforms of interest for coherent 400G pluggable optics. While still important for pluggables, disaggregated transponder shelves rank third, selected by 40%. The survey results confirm what Heavy Reading has been hearing from CSPs in presentations and in one-on-one discussions all year: coherent 400G pluggable optics are at the heart of a resurgence of interest in IPoDWDM.

Figure 11: Where do you plan to physically place coherent 400G pluggable optics?

CSPs are not only interested in evaluating IPoDWDM architectures, but they also intend to move quickly with their adoption, based on survey results. Nearly one-quarter of CSPs surveyed (22%) already have an active plan to deploy coherent pluggables in 2021, and an additional 44% have plans for future deployments beyond 2021. Combining the responses, a full two-thirds (66%) of CSPs surveyed intend to deploy IPoDWDM in their networks.

A further 30% of respondents do not have firm plans but are currently in the education phase (see Figure 12).

Figure 12: What are your plans for converging coherent pluggable optics into your routers? (Global)

Plans for converging coherent pluggable optics on routers vary greatly when comparing US versus RoW respondents. While 29% of US CSPs surveyed have active plans to deploy in 2021, just 14% of RoW CSPs have active plans. Furthermore, 44% of RoW CSPs surveyed are in the education phase of learning about coherent pluggable integration, with no current plans (see Figure 13).

Figure 13: What are your plans for converging coherent pluggable optics into your routers? (US vs. RoW)

Historically, cost savings is one of the primary benefits (if not the primary benefit) driving the adoption of pluggable optics for both datacomms and telecoms. Cost savings is also a primary benefit of IPoDWDM architectures. In the survey, Heavy Reading assessed the importance of 400G coherent optics in IPoDWDM to TCO savings when compared to traditional transponder-based networks.

Unsurprisingly, survey results show that cost savings are indeed critical in 400G-based IPoDWDM. When assessing TCO—measuring both capex and opex factors—roughly two-thirds of respondents (65% of the group) anticipate TCO savings of 20% or greater, while nearly one-quarter (22% of the group) expect TCO savings in excess of 40%. Over time, these figures may even tick higher, as 19% of CSPs surveyed are still in the evaluation phase and currently undecided (see Figure 14).

Figure 14: What level of TCO savings do you anticipate by converging 400G coherent pluggable optics onto routers for hop-by-hop transport when compared to traditional transponder-based architectures?

n=81

Source: Heavy Reading, 2021

CSPs are twice as likely to buy their coherent pluggable optics from DWDM system vendors compared to router vendors or third-party suppliers—even in IPoDWDM architectures. In the survey, 36% of CSPs selected DWDM system vendors as the preferred suppliers, compared to 17% for independent third parties and 16% for the router supplier. Still, at 28%, a significant minority of CSPs will take their pluggable coherent pluggable optics from whichever supplier has the lowest prices and best features for their requirements.

These findings offer a bit of a check and balance to the router suppliers, which stand to gain a great deal of power in transport networks based on integrated optics on IP elements (see Figure 15).

Figure 15: In an IPoDWDM network, who would you most prefer to buy the coherent pluggable optics from?

n=81

Source: Heavy Reading, 2021

As mentioned at the beginning of this section, coherent 400G pluggable optics is the primary catalyst for the IPoDWDM renaissance, but it is not the only important factor. SDN-based automation for transport networks has matured, alongside pluggable optics over the past five years, and is also an important contributing factor in IPoDWDM.

Heavy Reading asked respondents to rate the importance of vendor vision for converging pluggable optics combined with management and automation (in other words, full hardware and software convergence across layers). For 83% of the CSPs surveyed, vendor vision for hardware and software convergence with automation is at least “important” in network planning, and for 21% of the survey group, this vendor vision is “critical.” Significantly, not one respondent feels the combination of hardware and software convergence is unimportant, though a small percentage are still deciding (see Figure 16).

Figure 16: How important to your network planning is vendor vision for converging pluggable optics into routers combined with management and automation?

n=81

Source: Heavy Reading, 2021

The final question in this section addresses network modeling for converged optical and routing. Given the early stage, a surprisingly high 37% of CSPs have already modeled their network for convergence (see Figure 17). That data point sheds additional light on the earlier finding that two-thirds of CSPs intend to deploy IPoDWDM. Correlating the two findings, Heavy Reading concludes that the majority of CSPs that intend to deploy IPoDWDM have already done network modeling that supports their case to move forward.

Figure 17: Have you modeled your network for operating with converged optical and routing? (Global)

n=79

Source: Heavy Reading, 2021

As with other areas of IPoDWDM and coherent pluggable optics, differences arise when comparing results by geographic region. Half of US respondents (50%) have already modeled their networks with converged optical and routing, while just 20% of their RoW counterparts have done so. Still, two-thirds of RoW CSPs surveyed (66%) expect to do so in the future, indicating that the US CSPs are simply further along in their timelines and evaluations of the emerging architecture (see Figure 18).

Figure 18: Have you modeled your network for operating with converged optical and routing? (RoW)

n=44 US, 35 RoW

Source: Heavy Reading, 2021

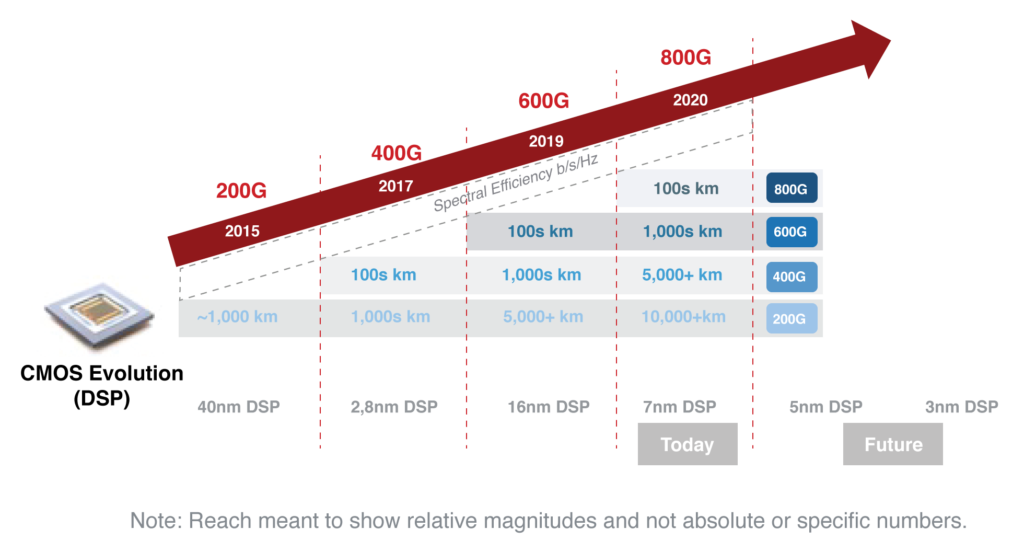

The final section of the survey focuses on the highest performance end of coherent optics as suppliers drive toward the maximum channel capacity and spectral efficiency while facing the physics constraints imposed by the Shannon Limit. The state-of-the-art in commercial systems today is 800Gbps optics powered by 7nm 90+ Gbaud DSPs. In contrast to 400G pluggables, these current 800G systems are embedded in line cards—although future developments aim for pluggable options, including the OIF’s 800G Coherent project. Figure 19 plots the evolution of coherent optics over multiple generations of DSPs. Note that, for any data rate, each new generation provides greater reach than the previous generation.

Figure 19: Embedded coherent optical engine evolution

Source: Heavy Reading, 2021

Few CSPs are clamoring for 800G coherent optics right away, but many do see 800G as an important data rate to be used alongside 400G over the next two years. In the survey, 10% of respondents report that 800G is “critical” and needed right away, while a plurality of 44% report that 800G is “important” over the next 24 months. Just 10% of CSPs surveyed believe that 800G is “not important” and that 400G is the highest data rate that will be required over the time period (see Figure 20).

Figure 20: Thinking about your forecast traffic demands over the next 24 months, how important are embedded 800G coherent optics for your transport network?

n=81

Source: Heavy Reading, 2021

With 800G commercially available from two systems suppliers as of 4Q21 (Ciena and Infinera), a growing number of operators are deploying 800G-capable systems in their networks. In the survey, 12% of CSPs report they are already deploying 800G or have plans to deploy by year-end. The next two years look promising for coherent 800G adoption as an additional 41% of CSPs surveyed expect to deploy during that timeframe. Still, one-third of CSPs (33%) anticipate coherent 800G adoption in 2024 or later (see Figure 21).

Figure 21: When do you expect to deploy embedded 800G coherent optics in your network? (Global)

n=81

Source: Heavy Reading, 2021

Expectations for deploying embedded 800G coherent optics vary greatly by geographic region, with US respondents having much more aggressive timelines compared to their RoW counterparts. While 22% of US CSPs surveyed are already deploying 800G, none of the RoW respondents have 800G in their networks in 2021. Furthermore, while US CSPs expect continued strong adoption of 800G in 2022 and 2023, the majority of RoW CSPs in the survey (53% of the RoW group) expect 800G deployments will begin in 2024 or later (see Figure 22).

Figure 22: When do you expect to deploy embedded 800G coherent optics in your network? (US vs. RoW)

n=45 US, 36 RoW

Source: Heavy Reading

As described in Figure 19 (Embedded coherent optical engine evolution), 800G is a maximum data rate for 7nm DSPs operating at a 90+ Gbaud symbol rate. Higher order modulations deliver 800G data rates at distances measured in the hundreds of kilometers, while lower order modulation rates can be used to deliver lower data rates at distances measured in the thousands. Therefore, 800G coherent optics can address a wide range of metro, long-haul, and even subsea applications. The vast majority of initial applications have been long haul/subsea, as internet content providers (ICPs) and CSPs seek the maximum data rate over many thousands of kilometers.

Heavy Reading asked CSPs to estimate the percentage of their networks that will be deployed using embedded 800G coherent optics over the next five years. Heavy Reading also asked respondents to estimate separately for metro networks and for long-haul/subsea networks.

Figure 23 shows those results. For long-haul/subsea networks, nearly half (49%) expect greater than 20% of wavelengths will be deployed with 800G coherent optics. At 44%, slightly fewer expect greater than 20% of 800G coherent wavelengths in their metro networks over the same timeframe. Results indicate an expected strong role for coherent 800G technology in both metro and long-haul/subsea segments, as CSPs choose the right modulation format to match their capacity and reach their needs.

Figure 23: Between now and 2025, what portion of your metro network and long-haul/subsea wavelengths do you anticipate will be deployed with embedded 800G coherent optics?

n=81

Source: Heavy Reading, 2021

Finally, Heavy Reading wanted to understand the role of DWDM vendor incumbency in CSPs’ selection process for 800G coherent optics. The data shows that existing relationships and incumbency are less important than best-in-class performance and other factors. Nearly three-quarters of CSPs surveyed (74%) are at least “somewhat likely” to choose a non-incumbent supplier for 800G, with 17% of the survey group “very likely” to choose a new supplier. Just 6% are “not likely at all” to change suppliers (see Figure 24).

Figure 24: How likely are you to deploy embedded 800G coherent optics from a different vendor than your current DWDM supplier(s)?

n=81

Source: Heavy Reading, 2021

Past research in optical networks has shown that incumbency is typically a lower priority compared to other selection criteria, including performance, costs, and others. Additionally, on the highest performance end of coherent optics, the high complexity and costs of building optics are causing supplier attrition. Only a handful of DWDM vendors will commercialize embedded 800G, so many CSPs may have no other option but to switch suppliers.

As a final note, beyond current 800G technology, work is well underway defining the next generation of highest performance DSPs. Acacia has announced a 5nm DSP that will deliver single channel 1.2Tbps at a 140 Gbaud symbol rate (in 150GHz channel spacing), with commercial availability expected in early 2023. Suppliers that have introduced or are planning 7nm DSPs must decide whether to also introduce 5nm products or skip 5nm DSPs and instead build at 3nm. Currently, this is a topic of much debate and discussion.

In this special webinar, Heavy Reading will be joined by leading experts from Cisco, Infinera and Juniper to unveil key findings from Heavy Reading’s 2021 global coherent optics operator survey and plot a roadmap for both high-performance embedded optics at 800 Gbit/s and 400G pluggable optics.

Sterling Perrin

Sr. Principal Analyst – Optical Networking & Transport

Tim Doiron

Senior Director, Solution Marketing, Infinera

Lorenzo Ghioni

Sr. Director Product Management Optical Systems, Cisco

Dirk van den Borne

Director System Engineering, Juniper Networks

Further Reading

ICT Enterprise Insights 2020-21 – Global ICT Drivers and Technology Priorities, September, 2020

The Gravitational Laws of Customer Experience, June 2020

The Evolution of Account-Based Marketing to Account-Based Engagement in B2B Enterprises, March, 2019

Heskett, J.L., Sasser W.E. Jr., Schlesinger, L.A., The Service Profit Chain, Free Press, New York, 1997

Copyright Notice and Disclaimer

The Omdia research, data and information referenced herein (the “Omdia Materials”) are the copyrighted property of Informa Tech and its subsidiaries or affiliates (together “Informa Tech”) and represent data, research, opinions or viewpoints published by Informa Tech, and are not representations of fact.

The Omdia Materials reflect information and opinions from the original publication date and not from the date of this document. The information and opinions expressed in the Omdia Materials are subject to change without notice and Informa Tech does not have any duty or responsibility to update the Omdia Materials or this publication as a result.

Omdia Materials are delivered on an “as-is” and “as-available” basis. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in Omdia Materials.

To the maximum extent permitted by law, Informa Tech and its affiliates, officers, directors, employees and agents, disclaim any liability (including, without limitation, any liability arising from fault or negligence) as to the accuracy or completeness or use of the Omdia Materials. Informa Tech will not, under any circumstance whatsoever, be liable for any trading, investment, commercial or other decisions based on or made in reliance of the Omdia Materials

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Gabriel leads mobile network research for Heavy Reading. Starting from a system architecture perspective, his coverage area includes RAN, core, and service-layer platforms. Key research topics include 5G, LTE Advanced, virtual RAN, software-based mobile core, and the application of cloud technologies to mobile networking.

Gabriel has more than 15 years’ experience as a mobile network analyst. Prior to joining Heavy Reading, he was Chief Analyst for Light Reading’s Insider research service; before that, he was editor of IP Wireline and Wireless Week at London’s Euromoney Institutional Investor.

This Heavy Reading report is based on a web-based survey of network operators worldwide conducted in September 2021. Respondents were drawn from the network operator list of the Light Reading readership database. After reviewing responses, 81 were deemed qualified participants and were counted in the results. To qualify, respondents had to work for a verifiable network operator and be involved in network planning and/or purchasing network equipment. Additional screening was conducted to remove incomplete surveys and bad responses. The full survey demographics are detailed in the charts below.

Figure 1: Survey response demographics

Infinera is a global supplier of innovative open optical networking solutions that enable carriers, cloud operators, governments, and enterprises to scale network bandwidth, accelerate service innovation, and automate network operations. Infinera solutions deliver industry-leading economics and performance in long-haul, submarine, data center interconnect, and metro transport applications, powered by the world’s best application-optimized embedded and pluggable optical engines. Our agile, open, compact, and modular networking platforms enable network operators to rapidly, operationally, and easily take advantage of best-in-class technology. Over 40 years of experience and 1900+ patents power our carrier-class products and services worldwide. We serve over 500 customers, including 9 of the top 10 Tier 1 operators and 7 of the top 9 internet content providers. To learn more about Infinera, visit www.infinera.com or read our blogs.

Read More:

Cisco (NASDAQ: CSCO) is the worldwide leader in technology that powers the Internet. Cisco inspires new possibilities by reimagining your applications, securing your data, transforming your infrastructure, and empowering your teams for a global and inclusive future. Discover more on The Network and follow us on Twitter.

Juniper’s 400G routing and switching portfolio offers the industry’s most comprehensive and high-performing platforms architected to improve customer experiences. Choose from the broadest 400G portfolio including PTX Series Routers, MX Series Routing Platforms, ACX Series Universal Routers and QFX Series Switches.

These solutions are optimized for scale-up and scale-out use cases, including core, peering, data center edge, data center interconnect (DCI), and multiservice edge applications. With 400G and 800G-ready custom ASIC designs, customers can increase efficiencies throughout theirinfrastructure while keeping their network secure, customizable, low-cost, and evolving it for the experience-first era.

Additional Resources:

Sterling Perrin

Sr. Principal Analyst – Optical Networking & Transport

Sterling Perrin is a Senior Principal Analyst within Heavy Reading, which delivers custom research and analysis for the telecommunications industry. His area of coverage is transport, including optical networks, packet networks, and 5G transport. Sterling has more than 20 years’ experience in telecommunications as an industry analyst and journalist.

Sterling is a frequent speaker at telecom industry events and a highly sought-after source among the business and trade press. His opinions have appeared in The Financial Times, The New York Times, Investor’s Business Daily, Lightwave, Telephony, CNET News, Information Week and CIO Magazine, among many others. In addition to chairing and moderating Light Reading events, Sterling is a NGON & DCI World Advisory Board member and past member of OFC’s N5 Market Watch Committee.

Sterling joined Heavy Reading after five years at IDC, where he served as lead optical networks analyst, responsible for the firm’s optical networking subscription research and custom consulting activities. Prior to IDC, Sterling worked for Standard & Poor’s, where he delivered global industry analysis on a range of IT segments. He is a former journalist and editor at Telecommunications Magazine, and has also done consulting work for the research firm Current Analysis.

Optical networking is hitting an inflection point as coherent innovation splits on two different, but equally important, axes. On one axis, embedded optics drives capacity toward 1 Tbit/s per wavelength as the laws of physics brush up against maximum channel capacity as defined by the Shannon limit. On the other axis, compact pluggable optics are converging at 400Gbit/s transmission, the data rate that is set to play a dominant role in optical networks over the next decade.

In this special webinar, Heavy Reading will be joined by leading experts from Cisco, Infinera and Juniper to unveil key findings from Heavy Reading’s 2021 global coherent optics operator survey and plot a roadmap for both high-performance embedded optics at 800 Gbit/s and 400G pluggable optics.

Sterling Perrin

Senior Principal Analyst – Optical Networks & Transport, Heavy Reading

Tim Doiron

Senior Director, Solution Marketing, Infinera

Lorenzo Ghioni

Sr. Director Product Management Optical Systems, Cisco

Dirk van den Borne

Director System Engineering, Juniper Networks